Texas CRE: Office Space Trends & Statistics

Overview of the office market in Texas

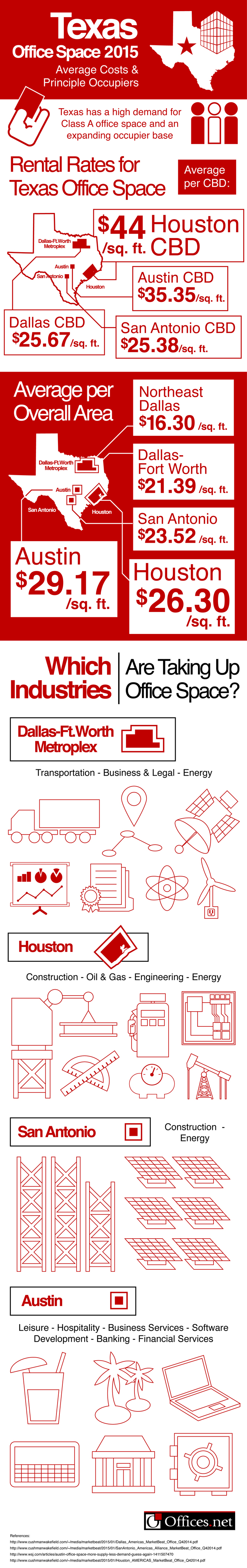

According to a recent Cushman and Wakefield report, the office market in the Lone Star state is robust and has been marked by a consistently high demand for Class A space and an expanding occupier base. This is particularly true of the Dallas-Fort Worth area, where a thriving job market has prompted several corporations to relocate to larger premises.

Towards the end of 2014, average vacancy rates in this area had dropped from 17.9 per cent to 16.6 per cent, thus reaching their lowest levels since 2010. By the end of Q4 2014, more than 13.8 million square feet had been leased or sold in the Dallas-Fort Worth area.

Strong demand in this area is also reflected in the speculative development pipeline, where 65 per cent of the more than 6 million square feet of office space under construction has already been pre-leased.

![]()

![]()

![]()

![]()

In Austin, a bustling service sector has been the driving force behind declining vacancy rates. Over the past year, these have dropped to a new low of 8.6 per cent, a figure that represents a significant decrease over the previous year’s 11.6 per cent average.

The local market is characterized by a steady supply of new Class A space, and it is expected that during 2015 more than 2.3 million square feet will become available along San Clemente, Capital Ridge, and the Rollingwood Center.

San Antonio is one of the leading real estate markets in the country. This auspicious state of affairs has been mostly fueled by the rapid economic growth associated with the expansion of the oil, gas, manufacturing, and biotech sectors.

Vacancy rates for Class A space have decreased significantly over the past 12 months, falling to 15.1 per cent in December 2014. Leasing activity levels reached the 1.6 million square feet mark in 2014, and they are set to keep increasing this year as newly developed class A space becomes available in areas to the north and north west of the city center.

Lastly, Houston’s resilient economy has been driving strong demand for office space. At the time of writing, there were more than 10.5 million square feet of office space under construction in and around the city, mainly along the Katy Freeway, Richmond, and the Woodlands / Conroe area. Last year, vacancy rates dropped to 11.9 per cent.

Office floor space: Rental values by area

In the Dallas-Fort Worth area average direct asking rents stand at $21.39 / sq ft. Some sub-markets of the Dallas CBD command the highest rents in the area, averaging $38.17 / sq ft in Preston Center, $36.18 in Turtle Creek and Uptown, and $34.30 in the I-30 Corridor. The lowest rents concentrate in areas like Northeast Dallas ($16.30 / sq ft), the Stemmons Freeway ($18.51), and Southwest Dallas ($21.70). Rents in Fort Worth remain stable across all sub-markets and average $29.50 / sq ft.

San Antonio‘s limited city center supply has pushed rental values to an average of $25.38 / sq ft. Elsewhere in San Antonio, direct asking rents have increased by approximately 0.7 per cent and range between $19.62 / sq ft and $23.52 / sq ft.

Direct gross rental rates in Houston have increased by just over 10 per cent in the past 12 months and currently stand at an average of $26.30 / sq ft city-wide. Rental values are at their highest in the central business district, where rates of $44 / sq ft are commonplace. The cost of office space is also above-average in Westheimer / Gessner ($41.78 / sq ft), South Main ($41), and the Buffalo Speedway ($40.50). On the lower end of the scale we find office properties in NASA / Clear Lake ($23.23) and in the eastern suburbs ($24).

In Austin, asking rental rates have remained relatively unchanged over the past 12 months and currently average $29.17 sq / ft. As one would expect, rental costs are higher for offices in the central business district, where they average $35.35 / sq ft and can be as high as $43.12. Next are neighborhoods to the south west of the city center ($32.27 / sq ft), where a significant amount of office space is currently under construction. The lowest rents can be found in Round Rock ($22.80 / sq ft), North Central ($24.11), and the south east ($25.11).

Occupiers by industry

Dallas-Fort Worth: transportation (Southwest Airlines), business and legal services (Shackelford, Melton, McKinley & Norton, Polsinelli, Grant Thornton, and Locke Lord) and the energy sector (EnLink Midstream).

Houston: construction, oil and gas, engineering, and energy.

San Antonio: construction and energy.

Austin: leisure, hospitality, business services, software development, banking, and financial services.

http://www.cushmanwakefield.com/en/research-and-insight/

http://www.cushmanwakefield.com/~/media/marketbeat/2015/01/Dallas_Americas_MarketBeat_Office_Q42014.pdf

http://www.cushmanwakefield.com/~/media/marketbeat/2015/01/SanAntonio_Americas_Alliance_MarketBeat_Office_Q42014.pdf

http://www.wsj.com/articles/austin-office-space-more-supply-less-demand-guess-again-1411507470

http://www.cushmanwakefield.com/~/media/marketbeat/2015/01/Houston_AMERICAS_MarketBeat_Office_Q42014.pdf