September 1st, 2022

Houston Office Market

Latest data from Q2 2022 shows Houston’s total office space inventory at 349.5 million square feet, a significant bump in supply from the mid-2021 figure of 173 million square feet. Despite the increase in stock, there have finally been gains in occupancy, with Q1 signalling this healthy marker for the first time since the start of the pandemic.

There were hints of this recovery at the end of 2021. The trend of last year’s subpar market performance was bucked by Class A and trophy office space (Class A+), which accounted for more than 60% of all leasing activity in Houston during Q3 2021. This positive influence has continued into Q2 2022, with Class A demand being the sole driver for occupancy gains in roughly half of Houston’s office submarkets.

Recently refurbished Class A offices, in developments built after 2005, are bucking the vacancy rate trends. These buildings report only 17% vacancy in Q2 2022, compared to the overall Class A vacancy rate of 25.6%. The new renovation programs undertaken by these mid-age office suppliers have clearly been a hit with Houston businesses, serving to satisfy post-pandemic amenity demands better than their newly developed A Grade counterparts.

Despite these low vacancy rates, the five largest leasing deals during Q2 2022 were for new and Class A CBD office space. This trend can be further illustrated by the newly completed Texas Tower, with occupancy already at 70% leased, despite only opening in the first quarter of 2022. As with the vast majority of major cities in the United States, the Houston CBD appears to be the focal point for the highest activity.

Key Takeaways

- Inventory – 349.5 million square feet

- Overall vacancy – 23.4% (a slight decrease from Q1’s 23.6%)

- Net absorption – negative 90,000 square feet (due to coming off the back of the bumper mid-year figure of +641,7000 when several substantial tenants moved into newly completed offices)

- Availability – 27.6%

- Average asking rents – $30.80 (up 1.9% YOY)

- Investment sales – $156 per square foot (up from $116 in Q2 2021)

Read the rest of this entry »

Tags: 2022, coworking, Houston, industrial, market reports, Office Space, retail, vacancy rates

Posted in Best Cities for Business in the USA, CRE, Houston, Market Overviews | No Comments »

Add to: Del.icio.us | Digg

February 25th, 2021

In a previous blog post we examined the performance of the commercial real estate market in some major US cities. This is the second article in this series, which uses data from late 2020 and early 2021 to examine vacancy and supply rates in cities such as Los Angeles, Chicago, Atlanta and Houston. These statistics illustrate the impact of COVID-19 on the commercial property rental market, as well as the types of properties that are holding strong in the face of negative trends.

In a previous blog post we examined the performance of the commercial real estate market in some major US cities. This is the second article in this series, which uses data from late 2020 and early 2021 to examine vacancy and supply rates in cities such as Los Angeles, Chicago, Atlanta and Houston. These statistics illustrate the impact of COVID-19 on the commercial property rental market, as well as the types of properties that are holding strong in the face of negative trends.

Los Angeles

Los Angeles is a hub for creative, media, and entertainment companies, many of which are office-based. The city’s proximity to major cargo ports makes it convenient for logistics and distribution businesses, both of which have kept the industrial real estate market strong.

Offices

- Vacancy rates in downtown Los Angeles are 21.5%.

- In Q4 20202, there was more than 5.5 million square feet for vacant space, with 3.4 million feet being in the Financial District.

- The majority of vacant inventory involves Class A offices.

- Supply increased by more than 2 million square feet in the past 12 months.

- No new supply is expected to enter the market as no projects are currently under construction in the CBD area.

- Vacancy rates average 22.5% outside of the CBD, however, they reach 56% in the Fashion District.

- Vacancy rates are just under 18% in the Greater Los Angeles area.

Read the rest of this entry »

Tags: 2021, Atlanta, Brooklyn, chicago, Houston, Los Angeles, Seattle, vacancy and supply

Posted in Atlanta, Best Cities for Business in the USA, Brooklyn, Chicago, Houston, Los Angeles, Office Space Forecasts and Trends, Seattle, Trends and Statistics | No Comments »

Add to: Del.icio.us | Digg

May 6th, 2015

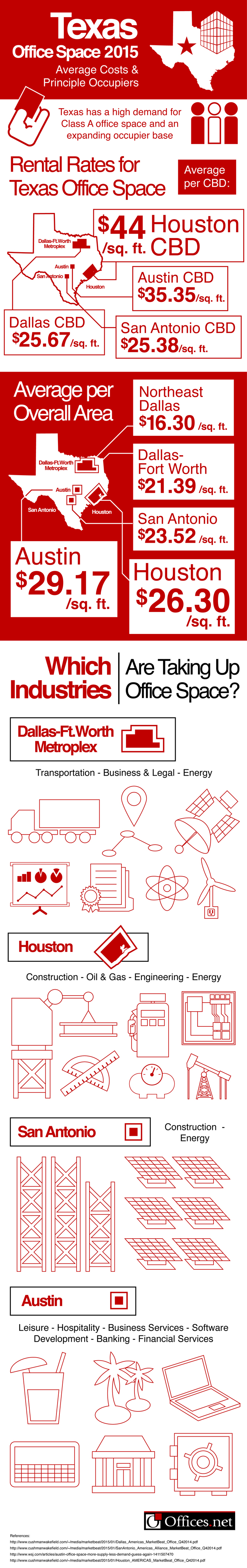

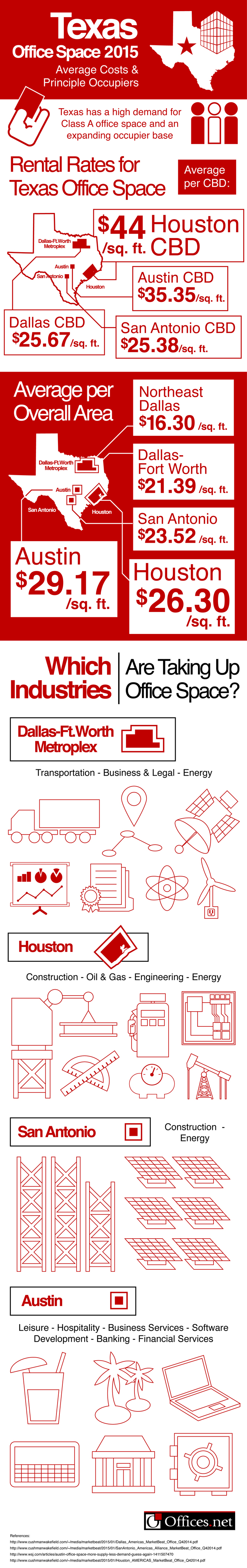

Overview of the office market in Texas

According to a recent Cushman and Wakefield report, the office market in the Lone Star state is robust and has been marked by a consistently high demand for Class A space and an expanding occupier base. This is particularly true of the Dallas-Fort Worth area, where a thriving job market has prompted several corporations to relocate to larger premises.

Towards the end of 2014, average vacancy rates in this area had dropped from 17.9 per cent to 16.6 per cent, thus reaching their lowest levels since 2010. By the end of Q4 2014, more than 13.8 million square feet had been leased or sold in the Dallas-Fort Worth area.

Strong demand in this area is also reflected in the speculative development pipeline, where 65 per cent of the more than 6 million square feet of office space under construction has already been pre-leased.

Read the rest of this entry »

Posted in CRE, Dallas, Houston, Texas, Trends and Statistics | No Comments »

Add to: Del.icio.us | Digg

January 12th, 2015

For several decades, Houston has been considered one of the most successful economies in the southern United States. In fact, and according to Forbes, Houston is the third best place to do business in the country. The city’s bustling and highly diverse economic scene is largely driven by the energy industry, and other important sectors include manufacturing, research and development, aerospace, information technology, and health care.

For several decades, Houston has been considered one of the most successful economies in the southern United States. In fact, and according to Forbes, Houston is the third best place to do business in the country. The city’s bustling and highly diverse economic scene is largely driven by the energy industry, and other important sectors include manufacturing, research and development, aerospace, information technology, and health care.

Being one of the most important corporate centers in North America, the city of Houston is well equipped to accommodate the real estate needs of existing and prospective businesses. This article looks at the most important trends affecting the commercial property market in Houston, having a special focus on the office market.

Key trends and developments in the Houston commercial property market

Generally speaking, over the past five years the Houston commercial real estate market has been characterised by high activity and construction levels and by increasing absorption rates. By the third quarter of 2014, the local market had absorbed 4.4 million square feet of office space, and by the end of the year a further 17.3 million sq ft of space were under development. The vast majority of new office developments were geared towards the needs of the energy sector, having a significant amounts of floor space being built at the city’s ExxonMobil campus and having a large number of pre-lease transactions closed by multinationals like BHP, Shell, and Nobel Energy.

Due to increased demand, citywide rental rates have been steadily climbing, and during 2014 alone they grew by an average 10.6 per cent. Higher increases were evident in commercial properties in the city’s business district. Vacancy rates have decreased from 12.9 per cent in 2013 to 11.9 per cent in 2014. While year-on-year leasing activity levels decreased during 2014, the figures are set to increase once again during the following 12 months. Read the rest of this entry »

Tags: commercial property, Houston, Texas

Posted in CRE, Houston, Texas, Trends and Statistics | No Comments »

Add to: Del.icio.us | Digg

In a previous blog post we examined the performance of the commercial real estate market in some major US cities. This is the second article in this series, which uses data from late 2020 and early 2021 to examine vacancy and supply rates in cities such as Los Angeles, Chicago, Atlanta and Houston. These statistics illustrate the impact of COVID-19 on the commercial property rental market, as well as the types of properties that are holding strong in the face of negative trends.

In a previous blog post we examined the performance of the commercial real estate market in some major US cities. This is the second article in this series, which uses data from late 2020 and early 2021 to examine vacancy and supply rates in cities such as Los Angeles, Chicago, Atlanta and Houston. These statistics illustrate the impact of COVID-19 on the commercial property rental market, as well as the types of properties that are holding strong in the face of negative trends.