Archive for the ‘CRE’ Category

May 24th, 2024

Thanks to its academic status and thriving innovation scene, Boston is considered one of the top business hubs on the East Coast. In particular, the city and the surrounding areas have become the destination of choice for many startups, not only due to the availability of talent and funding, but also given the quality and diversity of office accommodation options.

In this article, we offer detailed insights into the cost of renting office space in Boston, district by district.

Office market trends in Boston

Over the past decade, the Boston office space market has seen fluctuating performance, witnessing shifts in demand and supply. Initially, the growth of the tech and life sciences sectors contributed to the expansion of the office market, with the development of new and modern spaces that could accommodate the requirements of these occupiers. Low vacancy levels translated into increasing asking rates, in particular in areas like East Cambridge and Sommerville, while other tenants were pushed out of the market as they couldn’t always compete with the budget of occupiers like MIT, Novartis, and Google.

Read the rest of this entry »

Tags: Boston, Business Advice, commercial property, Commercial Real Estate, Office Market Trends, Office Rental, Office Space Trends and Forecasts

Posted in Boston, Business Districts, CBD's, CRE, Market Overviews, Office Planning, Office Space Forecasts and Trends | No Comments »

Add to: Del.icio.us | Digg

May 22nd, 2024

Washington DC is one of the largest US office space markets by square footage, which means local businesses are never short of options when it comes to finding a suitable office unit in the nation’s capital. For anyone interested in setting up an office or relocating to the city, we have created an overview of the costs involved in doing so.

The business environment in Washington DC

Washington DC has a thriving business ecosystem boasting excellent tech infrastructure, unparalleled access by road, sea, railway, and air, with three major airports, and office space options that can accommodate anything from large headquarters to micro-enterprises.

In addition, local companies enjoy access to a highly educated workforce, the presence of influential industry players in various industries, and several incentives to lessen the financial impact of running a business in the city.

Read the rest of this entry »

Tags: Business Advice, Commercial Real Estate, dc, Office Market Trends, Office Rental, Office-tips, statistics

Posted in Business Advice, Business Districts, CRE, DC, Office Planning, Office Talk | No Comments »

Add to: Del.icio.us | Digg

May 17th, 2024

In the intricate world of commercial real estate, few topics can be as consequential—yet often misunderstood—as depreciation. At its core, depreciation represents the gradual wear and tear of a property, reflecting its diminishing value over time. While this concept might seem straightforward, its implications ripple throughout various aspects of the industry, impacting not just the physical bricks and mortar, but the financial sheets and investment calculations of those involved.

For property owners, understanding depreciation is paramount. It influences their annual tax liability and shapes the long-term financial strategy behind their real estate holdings. Investors, on the other hand, often scrutinize depreciation schedules and methods to determine the potential returns of their ventures. As for lessees, while they might not directly deal with depreciation calculations, the underlying factors that cause depreciation can indirectly affect lease terms and rental rates.

This article delves into the nuances of commercial real estate depreciation, dissecting its mechanics and significance, especially within the context of the US market. Our goal is to shed light on this pivotal subject, equipping our readers with the knowledge to make informed decisions, whether they’re exploring new office spaces, considering an investment, or simply seeking to expand their understanding of commercial real estate dynamics in the USA.

Read the rest of this entry »

Tags: Business Advice, commercial property, Commercial Real Estate, Office Rental, Office Space, Office-tips

Posted in CRE, Entrepreneurs, Finance & Tax, Office Planning, Office Rental, Real Estate | No Comments »

Add to: Del.icio.us | Digg

May 10th, 2024

As one of the world’s leading business locations, New York City attracts office-based businesses with a wide range of requirements and budgets. In this article, we offer an in-depth analysis of the costs associated with renting office space in the Big Apple, so you can make the best decision when establishing your business footprint in the city.

Understanding the factors that influence office space costs

The cost of leasing office space in New York City‘s office market is influenced by a number of factors, including:

– Location: Although Manhattan still tops the list in terms of prestige, other areas fare better for ease of commute, as is the case of Brooklyn, and their popularity is reflected in rising prices when compared to the rest of the New York office space stock.

Read the rest of this entry »

Tags: commercial property, Commercial Real Estate, Manhattan, new york, Office Rental, Office Space

Posted in CBD's, CRE, Manhattan, New York, Office Planning, Office Rental, Office Talk | No Comments »

Add to: Del.icio.us | Digg

November 15th, 2022

Sustainability practices and green buildings are more popular than ever, making a strong LEED rating extremely desirable to both building owners and prospective occupants. In this blog post, we’ll take a closer look at what the LEED certification system is, why it matters, and some of the benefits you can expect from going through the certification process.

What is LEED Certification and What Does It Stand For?

If you’re unfamiliar with the term, LEED certification is a stamp of approval from the United States Green Building Council (USGBC) that signifies that a building or renovation project meets their high standards for environmentally friendly and sustainable construction. The acronym LEED stands for Leadership in Energy and Environmental Design. To receive LEED certification, a building must score points in several different categories, including water usage, indoor air quality, energy efficiency, reduction of waste, and material selection. In addition, the building must also meet a minimum threshold for overall energy efficiency. While the standards for LEED certification are relatively high, the benefits of certification are significant. Buildings with LEED certification often enjoy lower operating costs, higher rents, and increased market value. As a result, the number of LEED-certified buildings has grown rapidly in recent years, as more and more developers seek to cash in on the green building boom.

Read the rest of this entry »

Tags: 2022, commercial property, leed, LEED certification, LEED platinum

Posted in 2022, CRE | No Comments »

Add to: Del.icio.us | Digg

October 28th, 2022

Even though Florida’s office sector held strong during the pandemic, some investors are now feeling cautious as a result of geopolitical tensions, inflation, reduced spending, and rising interest rates. Despite the cooling sentiment, vacancy rates for commercial spaces are continuing to decrease across the State, especially in the office market. Fuelling Florida’s continued market positive is an overall increase in jobs, combined with low unemployment rates and generally favorable business conditions.

Market Highlights

Asking rates in Miami Beach have increased significantly, with some offices costing more than $120 sq/ft. On average, however, actual rental prices for this premium market are much lower, at roughly $70 sq/ft.

Additionally, the vacancy rate for Miami Beach is relatively low at 12.7%, just behind Brickell and Wynwood. Consequently, there has been a recent uptick in development activity driven by those looking to take advantage of the favorable conditions. Some notable projects include 1177 Kane Concourse (101,000 sq/ft) and Terminal Island Office Project (161,000 sq/ft), slated for delivery in 2024.

Read the rest of this entry »

Tags: 2022, flexible office space, industrial space, Miami, office market, retail space

Posted in 2022, CRE, Market Overviews, Miami, Trends and Statistics | No Comments »

Add to: Del.icio.us | Digg

September 21st, 2022

The Las Vegas commercial real estate (CRE) market has continued its recovery and stabilization since emerging from the pandemic. Positive signs for Q2 2022 include reduction in vacancies, positive net absorption, increased asking rents, and the delivery of two projects adding 188,909 square feet (sq/ft) office space to the market.

The Las Vegas commercial real estate (CRE) market has continued its recovery and stabilization since emerging from the pandemic. Positive signs for Q2 2022 include reduction in vacancies, positive net absorption, increased asking rents, and the delivery of two projects adding 188,909 square feet (sq/ft) office space to the market.

Strong pre-leasing and inquiry numbers for planned and under-construction projects, along with a rise in companies looking to the Las Vegas Valley to expand or relocate operations entirely, round out the positive sentiment currently seen in the market.

For office product in particular, Las Vegas saw a Q2 of mixed results. On the back of some notable expansion in Q1 2022, Southern NV’s office market has appeared to cool at mid-year. Investment prices reached record levels, however, vacancy rates edged higher. The Southwest submarket continues to see rising rents and additional leasing activity as tenants continue to funnel to this historically popular region.

There are currently 4,660 CRE spaces for lease in Las Vegas, amounting to 41.5 million square feet of space. Out of the 1280 commercial buildings available for sale, 505 have been leased in the past month, with 12 new listings coming onto market at time of print.

Key Takeaways

- Total inventory under construction – 468,400 square feet

- Overall vacancy – 12.7% (a rise from 12.5% in Q1)

- Net absorption – negative 284,323 square feet

- Availability – 6.2 million square feet

- Average asking rents – $28.50 per square foot per year (a decline of $0.02 from Q1)

- Investment sales – $50.5 million (down from $75.5 million in Q1)

Read the rest of this entry »

Tags: 2022, Class A, Class B, Class C, coworking report, economic reports, Las Vegas, nevada, office market report, Q2

Posted in CRE, Las Vegas, Market Overviews, Nevada | No Comments »

Add to: Del.icio.us | Digg

September 1st, 2022

Houston Office Market

Latest data from Q2 2022 shows Houston’s total office space inventory at 349.5 million square feet, a significant bump in supply from the mid-2021 figure of 173 million square feet. Despite the increase in stock, there have finally been gains in occupancy, with Q1 signalling this healthy marker for the first time since the start of the pandemic.

There were hints of this recovery at the end of 2021. The trend of last year’s subpar market performance was bucked by Class A and trophy office space (Class A+), which accounted for more than 60% of all leasing activity in Houston during Q3 2021. This positive influence has continued into Q2 2022, with Class A demand being the sole driver for occupancy gains in roughly half of Houston’s office submarkets.

Recently refurbished Class A offices, in developments built after 2005, are bucking the vacancy rate trends. These buildings report only 17% vacancy in Q2 2022, compared to the overall Class A vacancy rate of 25.6%. The new renovation programs undertaken by these mid-age office suppliers have clearly been a hit with Houston businesses, serving to satisfy post-pandemic amenity demands better than their newly developed A Grade counterparts.

Despite these low vacancy rates, the five largest leasing deals during Q2 2022 were for new and Class A CBD office space. This trend can be further illustrated by the newly completed Texas Tower, with occupancy already at 70% leased, despite only opening in the first quarter of 2022. As with the vast majority of major cities in the United States, the Houston CBD appears to be the focal point for the highest activity.

Key Takeaways

- Inventory – 349.5 million square feet

- Overall vacancy – 23.4% (a slight decrease from Q1’s 23.6%)

- Net absorption – negative 90,000 square feet (due to coming off the back of the bumper mid-year figure of +641,7000 when several substantial tenants moved into newly completed offices)

- Availability – 27.6%

- Average asking rents – $30.80 (up 1.9% YOY)

- Investment sales – $156 per square foot (up from $116 in Q2 2021)

Read the rest of this entry »

Tags: 2022, coworking, Houston, industrial, market reports, Office Space, retail, vacancy rates

Posted in Best Cities for Business in the USA, CRE, Houston, Market Overviews | No Comments »

Add to: Del.icio.us | Digg

May 6th, 2015

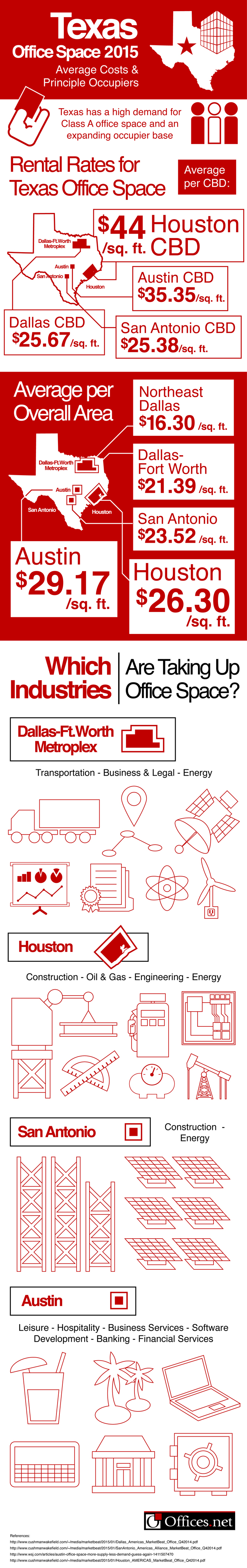

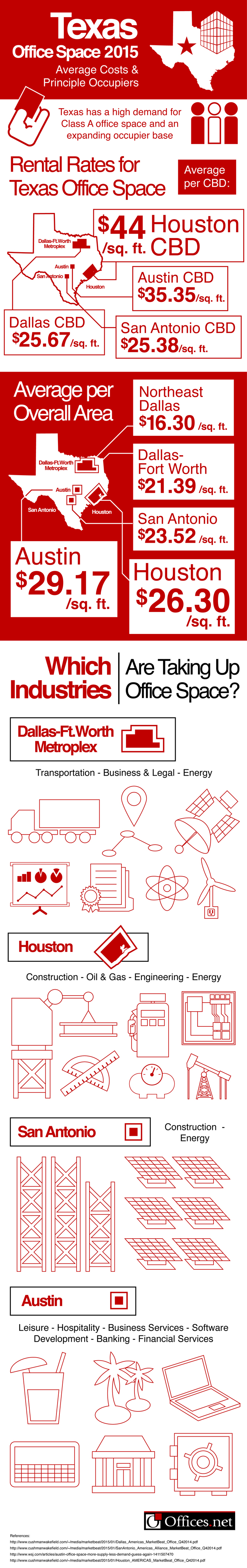

Overview of the office market in Texas

According to a recent Cushman and Wakefield report, the office market in the Lone Star state is robust and has been marked by a consistently high demand for Class A space and an expanding occupier base. This is particularly true of the Dallas-Fort Worth area, where a thriving job market has prompted several corporations to relocate to larger premises.

Towards the end of 2014, average vacancy rates in this area had dropped from 17.9 per cent to 16.6 per cent, thus reaching their lowest levels since 2010. By the end of Q4 2014, more than 13.8 million square feet had been leased or sold in the Dallas-Fort Worth area.

Strong demand in this area is also reflected in the speculative development pipeline, where 65 per cent of the more than 6 million square feet of office space under construction has already been pre-leased.

Read the rest of this entry »

Posted in CRE, Dallas, Houston, Texas, Trends and Statistics | No Comments »

Add to: Del.icio.us | Digg

March 16th, 2015

The city of San Francisco is one of the top business hubs in the Americas. The local business community is among the most vibrant and successful at global level, partly due to the huge pool of talent available in the city and its surrounding areas. A large number of Fortune 500 companies are based in the area, and business opportunities exist for enterprises operating in a wide range of sectors, from aerospace to health care and including electronics, consumer goods, retail, and telecommunications.

The undeniable appeal of San Francisco as a business location has attracted hundreds of prospective entrepreneurs to the area. If you are considering setting up a business in San Francisco, take a look at our detailed guide to commercial property in this thriving Californian city.

Key Trends in the San Francisco CRE Market

For the past two years, the local commercial property market in San Francisco has shown a variety of healthy indicators.

Read the rest of this entry »

Tags: 2015, commercial property, Office Market Trends, Office Rental, San Francisco

Posted in Business Spotlights, CRE, San Francisco, Trends and Statistics | No Comments »

Add to: Del.icio.us | Digg

The Las Vegas commercial real estate (CRE) market has continued its recovery and stabilization since emerging from the pandemic. Positive signs for Q2 2022 include reduction in vacancies, positive net absorption, increased asking rents, and the

The Las Vegas commercial real estate (CRE) market has continued its recovery and stabilization since emerging from the pandemic. Positive signs for Q2 2022 include reduction in vacancies, positive net absorption, increased asking rents, and the