October 6th, 2015

Centered on the north-central region of the country, the Midwest United States includes 12 states including Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota and Wisconsin. Although major urban centers such as Chicago are known around the world as key economic drivers, the Midwest is also home to several smaller cities that provide promising conditions for new businesses. WalletHub’s 2015 ranking of the best cities to start of a business in the United States included six Midwestern cities in the top 20. The ranking used a number of metrics, from the five-year survival rate of businesses to the affordability of office space.

Centered on the north-central region of the country, the Midwest United States includes 12 states including Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota and Wisconsin. Although major urban centers such as Chicago are known around the world as key economic drivers, the Midwest is also home to several smaller cities that provide promising conditions for new businesses. WalletHub’s 2015 ranking of the best cities to start of a business in the United States included six Midwestern cities in the top 20. The ranking used a number of metrics, from the five-year survival rate of businesses to the affordability of office space.

Springfield, Missouri

Springfield, Missouri ranked as the best Midwestern city to start of business in the United States, according to the 2015 study. The city also placed first nationally in terms of access to resources, including financing and affordable office space. Known as the Queen City of the Ozarks and the Birthplace of Route 66, Springfield is home to the Missouri State University and Drury University. The third largest city in Missouri is the economic hub of an area that spans 27 counties in Missouri and neighboring Arkansas and is home to some 1 million people. The economy is based on health care, manufacturing, retail, education and tourism. The city has also been recognized for its high quality of life, and in 2008 it was among the best communities for young people by the America’s Promise Alliance and relocating families by Worldwide ERC.

Sioux Falls, South Dakota

The same ranking found that Sioux Falls was the sixth best city to start a business in the US. With a growing population, the city also ranked second in terms of the best business environment in the United States. It was also named as the next big boom town by The Atlantic in 2013. The largest city in South Dakota, Sioux Falls is a diverse economic center focused on financial services, health care and retail. Sitting on the crossroads of interstates 90 and 29, the city is within a day’s drive from many major cities in the Midwest. The lack of a state corporate tax has helped attract a number of financial companies to Sioux Falls, including Wells Fargo and Citigroup. Read the rest of this entry »

Tags: 2015, Best US Cities for Business, Business Start Ups, Columbus, Fort Wayne, Kansas, Missouri, Ohio, Sioux Falls, South Dakota, Springfield, USA

Posted in Best Cities for Business in the USA, Business Spotlights, Cities & States, Trends and Statistics | No Comments »

Add to: Del.icio.us | Digg

May 6th, 2015

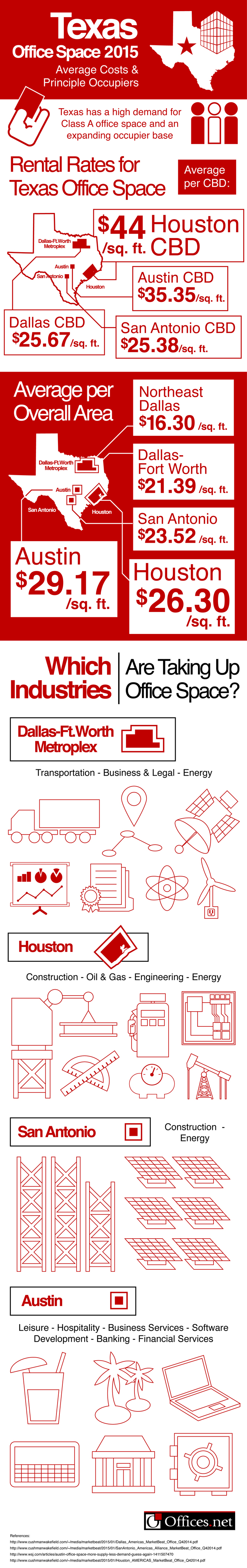

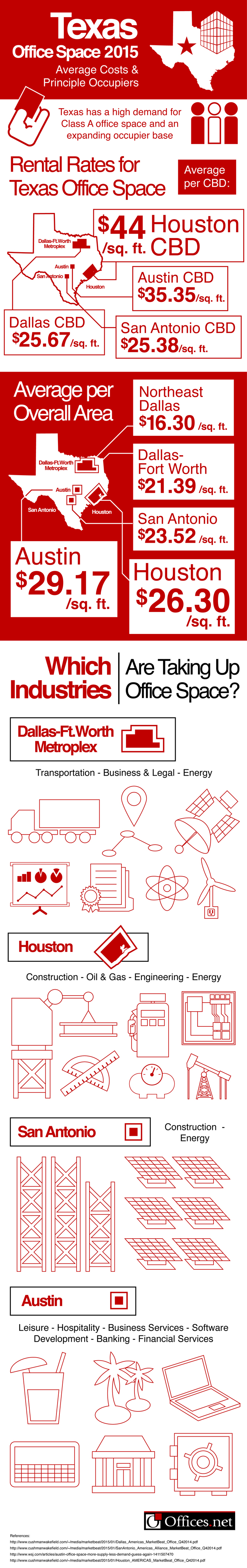

Overview of the office market in Texas

According to a recent Cushman and Wakefield report, the office market in the Lone Star state is robust and has been marked by a consistently high demand for Class A space and an expanding occupier base. This is particularly true of the Dallas-Fort Worth area, where a thriving job market has prompted several corporations to relocate to larger premises.

Towards the end of 2014, average vacancy rates in this area had dropped from 17.9 per cent to 16.6 per cent, thus reaching their lowest levels since 2010. By the end of Q4 2014, more than 13.8 million square feet had been leased or sold in the Dallas-Fort Worth area.

Strong demand in this area is also reflected in the speculative development pipeline, where 65 per cent of the more than 6 million square feet of office space under construction has already been pre-leased.

Read the rest of this entry »

Posted in CRE, Dallas, Houston, Texas, Trends and Statistics | No Comments »

Add to: Del.icio.us | Digg

March 16th, 2015

The city of San Francisco is one of the top business hubs in the Americas. The local business community is among the most vibrant and successful at global level, partly due to the huge pool of talent available in the city and its surrounding areas. A large number of Fortune 500 companies are based in the area, and business opportunities exist for enterprises operating in a wide range of sectors, from aerospace to health care and including electronics, consumer goods, retail, and telecommunications.

The undeniable appeal of San Francisco as a business location has attracted hundreds of prospective entrepreneurs to the area. If you are considering setting up a business in San Francisco, take a look at our detailed guide to commercial property in this thriving Californian city.

Key Trends in the San Francisco CRE Market

For the past two years, the local commercial property market in San Francisco has shown a variety of healthy indicators.

Read the rest of this entry »

Tags: 2015, commercial property, Office Market Trends, Office Rental, San Francisco

Posted in Business Spotlights, CRE, San Francisco, Trends and Statistics | No Comments »

Add to: Del.icio.us | Digg

January 12th, 2015

For several decades, Houston has been considered one of the most successful economies in the southern United States. In fact, and according to Forbes, Houston is the third best place to do business in the country. The city’s bustling and highly diverse economic scene is largely driven by the energy industry, and other important sectors include manufacturing, research and development, aerospace, information technology, and health care.

For several decades, Houston has been considered one of the most successful economies in the southern United States. In fact, and according to Forbes, Houston is the third best place to do business in the country. The city’s bustling and highly diverse economic scene is largely driven by the energy industry, and other important sectors include manufacturing, research and development, aerospace, information technology, and health care.

Being one of the most important corporate centers in North America, the city of Houston is well equipped to accommodate the real estate needs of existing and prospective businesses. This article looks at the most important trends affecting the commercial property market in Houston, having a special focus on the office market.

Key trends and developments in the Houston commercial property market

Generally speaking, over the past five years the Houston commercial real estate market has been characterised by high activity and construction levels and by increasing absorption rates. By the third quarter of 2014, the local market had absorbed 4.4 million square feet of office space, and by the end of the year a further 17.3 million sq ft of space were under development. The vast majority of new office developments were geared towards the needs of the energy sector, having a significant amounts of floor space being built at the city’s ExxonMobil campus and having a large number of pre-lease transactions closed by multinationals like BHP, Shell, and Nobel Energy.

Due to increased demand, citywide rental rates have been steadily climbing, and during 2014 alone they grew by an average 10.6 per cent. Higher increases were evident in commercial properties in the city’s business district. Vacancy rates have decreased from 12.9 per cent in 2013 to 11.9 per cent in 2014. While year-on-year leasing activity levels decreased during 2014, the figures are set to increase once again during the following 12 months. Read the rest of this entry »

Tags: commercial property, Houston, Texas

Posted in CRE, Houston, Texas, Trends and Statistics | No Comments »

Add to: Del.icio.us | Digg

Centered on the north-central region of the country, the Midwest United States includes 12 states including Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota and Wisconsin. Although major urban centers such as Chicago are known around the world as key economic drivers, the Midwest is also home to several smaller cities that provide promising conditions for new businesses. WalletHub’s 2015 ranking of the best cities to start of a business in the United States included six Midwestern cities in the top 20. The ranking used a number of metrics, from the five-year survival rate of businesses to the affordability of office space.

Centered on the north-central region of the country, the Midwest United States includes 12 states including Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota and Wisconsin. Although major urban centers such as Chicago are known around the world as key economic drivers, the Midwest is also home to several smaller cities that provide promising conditions for new businesses. WalletHub’s 2015 ranking of the best cities to start of a business in the United States included six Midwestern cities in the top 20. The ranking used a number of metrics, from the five-year survival rate of businesses to the affordability of office space.