Overview of USA Office Market

Overview of USA Office Market

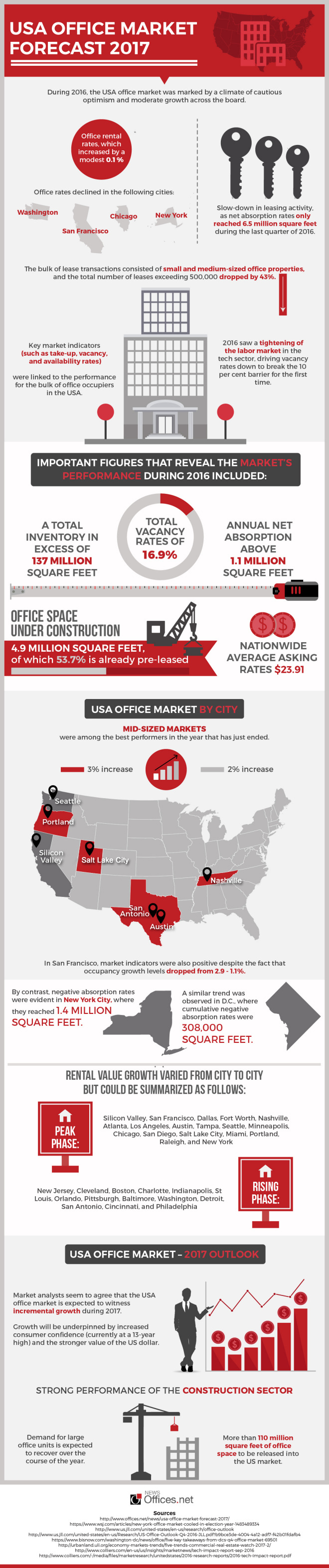

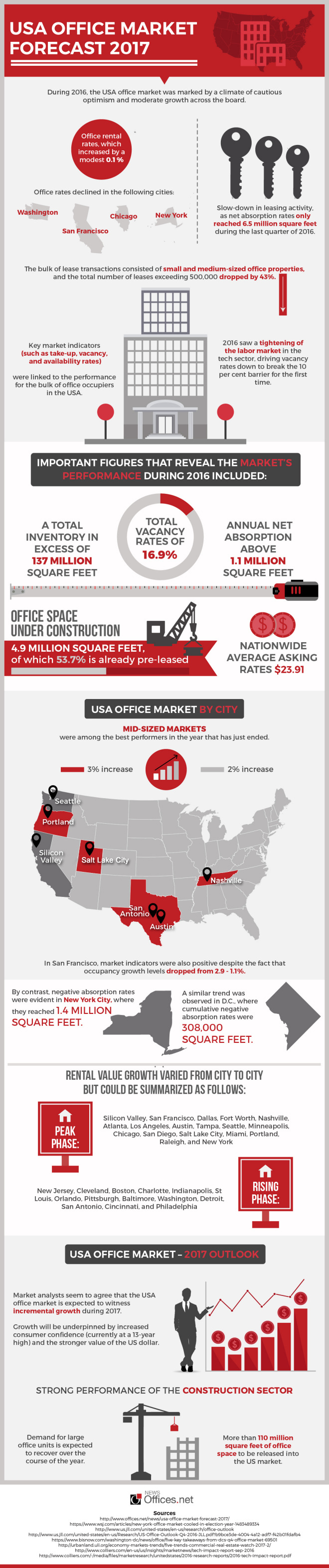

During 2016, the USA office market was marked by a climate of cautious optimism and moderate growth across the board. This was mostly evident in office rental rates, which increased by a modest 0.1 per cent or even declined in cities like Chicago, New York, Washington and San Francisco. This was coupled with a slow-down in leasing activity, as net absorption rates only reached 6.5 million square feet during the last quarter of 2016. The bulk of lease transactions consisted of small and medium-sized office properties, and the total number of leases exceeding 500,000 dropped by 43 per cent.

Key market indicators (such as take-up, vacancy, and availability rates) were linked to the performance of those industry sectors that make up for the bulk of office occupiers in the USA. 2016 saw a tightening of the labor market in the tech sector, driving vacancy rates down to break the 10 per cent barrier for the first time. This offset the relative stagnation in activity coming from occupiers involved in financial services, legal, and government.

Important figures that reveal the market’s performance during 2016 included:

– A total inventory in excess of 137 million square feet

– Total vacancy rates of 16.9 per cent

– Annual net absorption above 1.1 million square feet

– Nationwide average asking rates $23.91

– Office space under construction 4.9 million square feet, of which 53.7 per cent is already pre-leased

USA Office Market by City

Mid-sized markets were among the best performers in the year that has just ended. Portland, Nashville, Salt Lake City, and San Antonio were characterized by occupancy increases that averaged 3 per cent. In San Francisco, market indicators were also positive despite the fact that occupancy growth levels dropped from 2.9 to 1.1 per cent. Other regional office markets that did well included Austin, Silicon Valley, and Seattle. In these markets, occupancy growth averaged 2 per cent. Read the rest of this entry »

The US office market struggle to get back on its feet for most of 2021, despite the year starting with the expectation that this arm of the commercial real estate market would be on its way to recovery by Q3 to Q4. Ultimately, the emergence of the Delta and Omicron variants of COVID-19 resulted in forecasts being revised, and the recovery horizon was pushed to 2022.

The US office market struggle to get back on its feet for most of 2021, despite the year starting with the expectation that this arm of the commercial real estate market would be on its way to recovery by Q3 to Q4. Ultimately, the emergence of the Delta and Omicron variants of COVID-19 resulted in forecasts being revised, and the recovery horizon was pushed to 2022. The US office market has been dramatically transformed by the changes to work practices and mobility restrictions implemented throughout the course of 2020 and early 2021. Whilst it was predicted that the market would slowly rebound starting in recent months, the demands of office occupiers will have changed substantially since the start of the COVID-19 pandemic. Below is a brief overview of the main things to look for in an office space during the second half of 2021.

The US office market has been dramatically transformed by the changes to work practices and mobility restrictions implemented throughout the course of 2020 and early 2021. Whilst it was predicted that the market would slowly rebound starting in recent months, the demands of office occupiers will have changed substantially since the start of the COVID-19 pandemic. Below is a brief overview of the main things to look for in an office space during the second half of 2021. Commercial real estate was one of the hardest hit sectors following the coronavirus outbreak in 2020. The pandemic and the measures taken to curb its spread brought significant changes to office-based workplaces, driving a sharp and sudden increase in remote work practices. The most immediate consequence of this shift was a softening in rental activity due to the decreased need for physical office space in the short-term. As a result, 2020 ended with a marked decline in take-up volume and an increase in office vacancy rates across the nation.

Commercial real estate was one of the hardest hit sectors following the coronavirus outbreak in 2020. The pandemic and the measures taken to curb its spread brought significant changes to office-based workplaces, driving a sharp and sudden increase in remote work practices. The most immediate consequence of this shift was a softening in rental activity due to the decreased need for physical office space in the short-term. As a result, 2020 ended with a marked decline in take-up volume and an increase in office vacancy rates across the nation. An updated version of this post can be found by

An updated version of this post can be found by  New York City is home to more than 500 million square feet of

New York City is home to more than 500 million square feet of  Overview of USA Office Market

Overview of USA Office Market

Bolstered by a robust economic performance, the office market in Washington DC delivered a fine performance throughout 2015. Unemployment levels in the DC metropolitan area were at their lowest since 2008, reaching figures well below the US national average (4.3 per cent vs 5 per cent). These conditions have helped shape a real estate market that is predominantly favourable to landlords, as the following trends demonstrate:

Bolstered by a robust economic performance, the office market in Washington DC delivered a fine performance throughout 2015. Unemployment levels in the DC metropolitan area were at their lowest since 2008, reaching figures well below the US national average (4.3 per cent vs 5 per cent). These conditions have helped shape a real estate market that is predominantly favourable to landlords, as the following trends demonstrate: