Los Angeles County is home to the nation’s second largest metropolitan area and to one of the world’s most powerful economies. The county is made up of 88 cities and has approximately 300,000 employers, which provide jobs to a workforce of nearly 5 million people.

Los Angeles County is home to the nation’s second largest metropolitan area and to one of the world’s most powerful economies. The county is made up of 88 cities and has approximately 300,000 employers, which provide jobs to a workforce of nearly 5 million people.

Major Industries and Employers in Los Angeles County

Key industries include entertainment and media due to the presence of highly successful companies like Walt Disney, Warner Bros, and Paramount Pictures. Trade is also a strong economic driver due to the location of the Port of Los Angeles, situated in the southern part of the county, which is one of the state’s largest employers with over 800,000 employees.

Education and healthcare have been paramount to the local economy since the mid 20th century, as the county is home to prestigious institutions that include the University of California, California Institute of Technology, and Loyola Law School, as well as to healthcare corporations like CareMore, Health Net, and Molina Healthcare.

Other sectors worth mentioning include pharma, fashion, hospitality, tourism, financial services, and publishing. Tech-related activities have grown fast and now employ nearly 400,000 people, but the creative industry is by far the sector with the highest growth rates, supporting more than 740,000 jobs.

Key employers include CBRE, Metro-Goldwyn-Mayer, Snapchat, and Universal Pictures (Los Angeles), Walt Disney (Burbank), Riot Games and Hulu (Santa Monica), Toyota and Honda (Torrance), Isuzu Motors (Cerritos), and Avery Dennison (Glendale). Read the rest of this entry »

Commercial real estate was one of the hardest hit sectors following the coronavirus outbreak in 2020. The pandemic and the measures taken to curb its spread brought significant changes to office-based workplaces, driving a sharp and sudden increase in remote work practices. The most immediate consequence of this shift was a softening in rental activity due to the decreased need for physical office space in the short-term. As a result, 2020 ended with a marked decline in take-up volume and an increase in office vacancy rates across the nation.

Commercial real estate was one of the hardest hit sectors following the coronavirus outbreak in 2020. The pandemic and the measures taken to curb its spread brought significant changes to office-based workplaces, driving a sharp and sudden increase in remote work practices. The most immediate consequence of this shift was a softening in rental activity due to the decreased need for physical office space in the short-term. As a result, 2020 ended with a marked decline in take-up volume and an increase in office vacancy rates across the nation. The United States office market is characterized by its wide range of properties, ranging from affordable shared spaces to expensive trophy offices in some of the world’s most desirable business locations. In mid-2020, average gross rates for offices nationwide stood at $35 per square foot with the

The United States office market is characterized by its wide range of properties, ranging from affordable shared spaces to expensive trophy offices in some of the world’s most desirable business locations. In mid-2020, average gross rates for offices nationwide stood at $35 per square foot with the  An updated version of this post can be found by

An updated version of this post can be found by  Los Angeles County is home to the nation’s second largest metropolitan area and to one of the world’s most powerful economies. The county is made up of 88 cities and has approximately 300,000 employers, which provide jobs to a workforce of nearly 5 million people.

Los Angeles County is home to the nation’s second largest metropolitan area and to one of the world’s most powerful economies. The county is made up of 88 cities and has approximately 300,000 employers, which provide jobs to a workforce of nearly 5 million people. Louisville is a mid-sized urban center in Boulder County with a population of approximately 20,000 people. The city has a central location within Colorado and is within easy reach of other major cities, with Denver only a 30-minute drive away and

Louisville is a mid-sized urban center in Boulder County with a population of approximately 20,000 people. The city has a central location within Colorado and is within easy reach of other major cities, with Denver only a 30-minute drive away and  Overview of USA Office Market

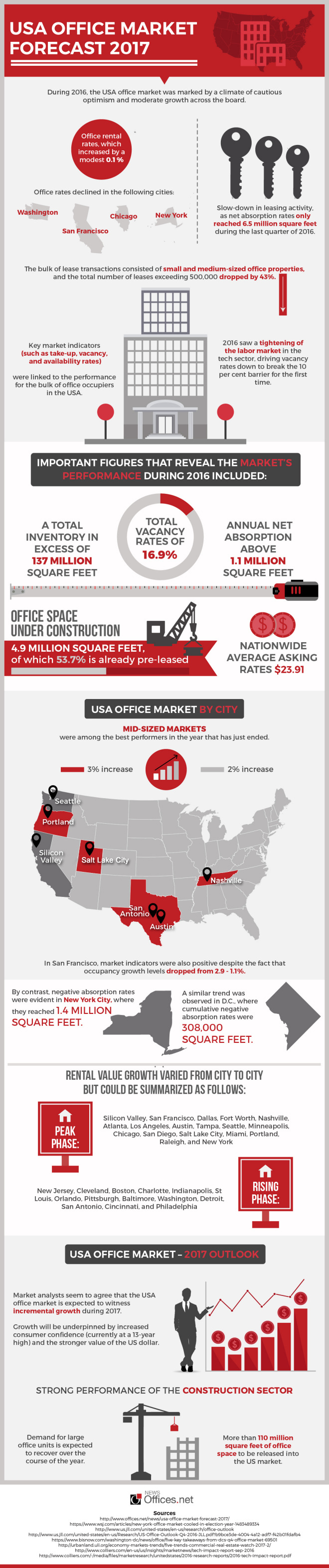

Overview of USA Office Market

Bolstered by a robust economic performance, the office market in Washington DC delivered a fine performance throughout 2015. Unemployment levels in the DC metropolitan area were at their lowest since 2008, reaching figures well below the US national average (4.3 per cent vs 5 per cent). These conditions have helped shape a real estate market that is predominantly favourable to landlords, as the following trends demonstrate:

Bolstered by a robust economic performance, the office market in Washington DC delivered a fine performance throughout 2015. Unemployment levels in the DC metropolitan area were at their lowest since 2008, reaching figures well below the US national average (4.3 per cent vs 5 per cent). These conditions have helped shape a real estate market that is predominantly favourable to landlords, as the following trends demonstrate: